As this could be the most widely anticipated recession in decades, investors are asking: Will there be a recession? How bad will it be? and What comes next?

The U.S. Federal Reserve’s aggressive campaign of interest rate hikes to combat persistent inflation has amplified the risk of recession. Recent banking sector turmoil, which will likely result in tighter credit conditions, could further that risk. One reliable indicator of a recession is an inverted yield curve, where the yield on short-term U.S. Treasury bonds is higher than the yield on longer-dated bonds, indicating that investors expect tough economic times ahead. But the historical timing of past recessions, once the yield curve is inverted, is not exact. In fact, even while the yield curve has been inverted for most of this year, domestic markets are up over 15% year-to-date. Why? Hope. Speculation. Naivete. Who knows. More importantly why bother trying to answer this question. In our view, it’s a fool’s game to try to time the market. Inflation stays sticky, the Fed keeps raising rates, big banks fail, and the market has gone higher. Instead of making predictions, simply acknowledging the landscape for stocks will be different than the recent past guides to our positioning.

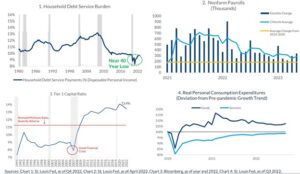

The macro uncertainties that exist provide us caution, not fear. But there can be a case that if we do enter a recession, it could be shallow, and the subsequent recovery could be stronger. First, at this point in the cycle, consumers have low debt relative to levels coming out of the Global Financial Crisis or even other more typical recessions. Second, the unemployment rate is at a multidecade low with strong wages and consumer confidence boosting consumer spending. Third, there may not be a need for large-scale deleveraging like there was during the Global Financial Crisis, because so many companies have been expecting economic weakness, and businesses have taken action, delaying orders to work excesses out of the economy. Fourth, the U.S. consumer sector is strong relative to past cycles. Healthy job markets, wage growth, and household wealth should be key catalysts for a more robust recovery.

Determining the exact start or end date of a recession is not only impossible but also not that critical. What is more important is to maintain a long-term perspective, so you can be resilient during those inevitable periods of volatility. Above all else, we should stay calm when investing ahead of and during a recession. Emotions can be one of the biggest roadblocks to strong investment returns, and this is particularly true during periods of economic and market stress.

Securities offered through Valmark Securities, Inc. Member FINRA, SIPC. Advisory Services offered through Valmark Advisers, Inc. A SEC registered investment advisor.130 Springside Drive, Akron, OH 44333 800.765.5201