Market Update: Q1 2025

With Q1 2025 now behind us, markets have navigated a shifting terrain of opportunities and uncertainties, driven by a new Trump administration’s push for tariffs, tax cuts, and deregulation. We are witnessing a significant global economic transition, marked by a new U.S. administration under President Trump, which has launched initiatives including increased tariffs, tax reductions and deregulation. While these measures have bolstered expectations for domestic growth, they’ve also reignited inflationary concerns. In response, the Federal Reserve held interest rates steady in March, having revised its GDP growth forecast down to 1.8% and inflation expectations upward to 2.8%. On the global front, shifting geopolitical dynamics and economic realignments are creating a blend of challenges and possibilities, reinforcing the need for a balanced and proactive approach as the year unfolds.

Market Performance Driven by Select Leaders

Market concentration continues to be a defining characteristic, with the so-called “Magnificent Seven”—Apple, Nvidia, Microsoft, Amazon, Tesla, Alphabet, and Meta—comprising 32% of the S&P 500. These influential companies, previously lifted by enthusiasm for artificial intelligence and electric vehicles, have collectively accounted for the S&P 500’s 4.3% decline this quarter. All seven experienced declines, with Tesla and Nvidia posting the most significant setbacks. While their size has amplified their impact on index performance, it also conceals a more nuanced picture—broader market segments have shown resilience. Sectors like energy and financials have begun to step forward, demonstrating healthy momentum. For investors with heavy exposure to mega-cap tech, however, this quarter has served as a reminder of the importance of diversification.

Tariffs and Their Market Implications

Tariff policy is again at the forefront, with the administration introducing new measures that have affected industries ranging from automotive to consumer goods. Recent initiatives, including broad-based tariffs targeting goods from Europe to Southeast Asia, have sparked a resurgence in trade tensions. While some domestic manufacturers welcome these moves, they present challenges for consumers and global supply chains and have led to heightened market volatility and uncertainty.

Tariffs, often remembered from high school history classes, are now central to today’s economic debate. The current approach echoes historical protectionist policies but is positioned as a strategy to address long-standing trade imbalances and encourage fairer trade practices. Supporters view this as a strategic tool to strengthen the U.S. economy and reduce reliance on foreign goods, while critics warn of potential escalation into a broader trade conflict with global repercussions.

While tariffs can contribute to inflation—especially in a prolonged or escalating scenario—their actual impact depends on scope, duration, and market response. A single, limited tariff may have a temporary effect on prices, but a sustained trade dispute could lead to long-term inflationary pressure and interest rate increases. The U.S. dollar has also reacted accordingly, often strengthening in response to rising tariffs due to reduced demand for foreign imports.

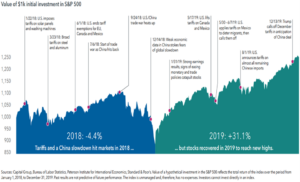

There are parallels to the first Trump administration’s trade policies. The 2018 tariffs on China triggered volatility, yet the markets rebounded strongly in 2019 following trade agreements and stable consumer spending. Although today’s environment is shaped by additional factors—including post-pandemic shifts, global conflicts, and inflation shocks—the resilience of the U.S. market remains a central theme. As we assess the impact of evolving trade strategies and federal spending adjustments, it’s vital to acknowledge that tariffs are one element within a broader economic picture. The key takeaway: Sound investment principles such as diversification and long-term focus continue to offer the best foundation for navigating uncertainty.

The chart below highlights how markets responded during similar trade policy periods in Trump’s first term, underscoring the value of maintaining perspective during times of change.

Looking Ahead

Looking Ahead

Despite prevailing challenges—ranging from trade tensions to shifting interest rate expectations—the outlook for 2025 remains constructive. Many of the headwinds tied to economic growth and global restructuring appear to be increasingly priced into the market, setting the stage for potential stabilization and selective opportunities. A disciplined investment approach, anchored in long-term strategy and risk awareness, will be essential as we move forward.

We remain cautiously optimistic about the longer road ahead and confident in the power of staying the course. Our team is committed to guiding you through the coming quarters with thoughtful insights and strategic advice, helping you make informed decisions in an ever-evolving environment.

Wishing you and your loved ones a joyful Easter season. We look forward to supporting your financial goals throughout 2025 and beyond.

Disclosure

Fee-based planning offered through Focus On Success, LLC, a State Registered Investment Advisor. Third Party Money Management offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc., member FINRA, SIPC. Focus On Success, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

All information in this market outlook is believed to be from reliable sources; however, no representation is made to its completeness or accuracy. All economic and performance information is historical and not indicative of future results. Diversification cannot assure a profit or guarantee against a loss. The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. Indices are unmanaged and do not incur fees. One cannot directly invest in an index