Market Insights at a Glance

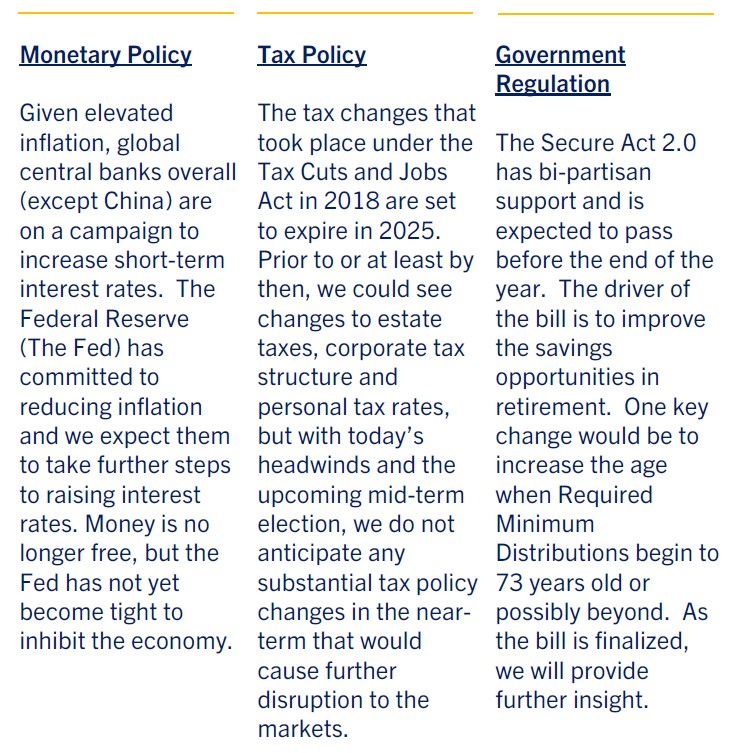

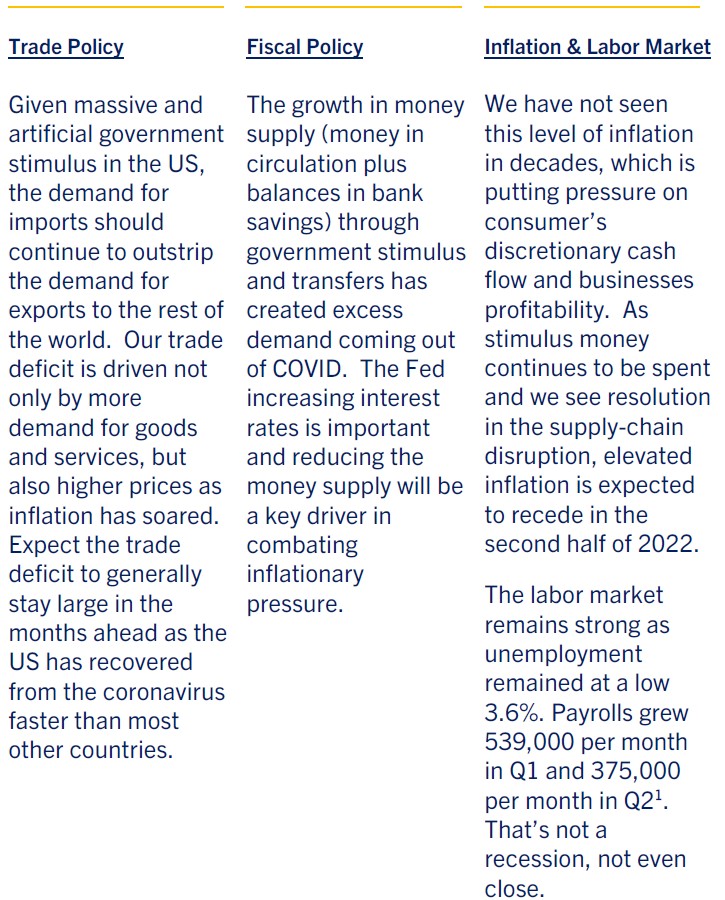

Geopolitical developments and the increase of the money supply have elevated volatility and our outlook of course continues to evolve. This summary is intended to aggregate the Firm’s current overall views and present an at-a-glance dashboard.

Our investment committee is aware of the policies driving markets, the headwinds our current economy is experiencing and the the positive changes that are occurring that will impact markets in the years ahead. We understand these are challenging times in our investing cycle, but long-term we believe innovation and operating efficiencies will drive profitability for strong companies well into the future.

Of the 12 recessions that have occurred since 1945 (the period we have access to daily S&P 500 prices) the median price increase in the S&P 500 two years after a recession was declared was 25%, and only one of the 12 periods showed a negative return[2]. The median two-year price increase from random purchase dates during those 77 years was only 17%, so the recession returns were actually higher[3] With the announcement of the second-quarter real GDP contracting for the second straight quarter, don’t be bothered, there is no evidence that below-average investment returns are likely to follow. We will continue to modify the allocations as market environments shift.

- Diversification continues to be important in today’s market environment.

- We believe in buying quality companies with strong balance sheets. Over the next few months, similar to our portfolio adjustments at the end of last year, we will continue to increase the allocation to dividend paying stocks.

- Europe, Asia and Emerging Market economies are being further impacted by the war in Ukraine and Russian energy, along with experiencing higher levels of inflation. For these main reasons, among others, we continue to overweight to domestic companies over international companies.

- While we view the stock portion of the allocation for long-term growth, fixed income has experienced downward pressure year-to-date, as we have seen the 10-Year Treasury increase over the past year from 1.25% to slightly less than 3% as of the end of July [4]. We believe fixed income will revert to being a diversifier for stocks in the years ahead.

- With the Federal Reserve raising short-term interest rates, bond pricing and income yields are starting to become attractive for investors. We continue to hold the duration of our bonds on the shorter end of the curve and have intentions of increasing duration throughout the summer as we watch the monetary policy further develop.

- For those in relying on current income from the portfolio, we have a smart avenue for income while the economy and markets address the current headwinds. We have structured the portfolio to generate income from stock dividends and bond interest, while maintaining short-term and intermediate bonds while stocks are volatile.

1 First Trust Monday Morning Outlook July 25, 2022.

2 Oakmark Funds Bill Nygren Market Commentary | 2Q22 Quarterly

3 Oakmark Funds Bill Nygren Market Commentary | 2Q22 Quarterly

4 First Trust Quarterly Outlook July 2022

Fee-based planning offered through Focus On Success, LLC, a State Registered Investment Advisor. Third Party Money Management offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc., member FINRA, SIPC. (130 Springside Dr. Suite 300 Akron, Ohio 44333-2431 Ph. 1-800-765-5201). Focus On Success, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

The material contained in this document is for informational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. The information provided has been derived from sources believed to be reliable but is not guaranteed the accuracy and does not purport to be a complete analysis of the material discussed. This material is not intended to provide and should not be relied on for tax or legal advice. Any information contained herein is of a general nature. You should seek specific advice from your tax or legal professional before pursuing any idea contemplated. Past performance is not an indication of future results. The Standard & Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. It is not possible to invest directly in an index. Diversification cannot assure a profit or guarantee against a loss.