The stock market has provided fairly consistent growth over the past decade and as high inflation, rising interest rates and the war in Ukraine continue to disrupt markets, it’s easy for investors to ask, “Will the market ever go up again?”

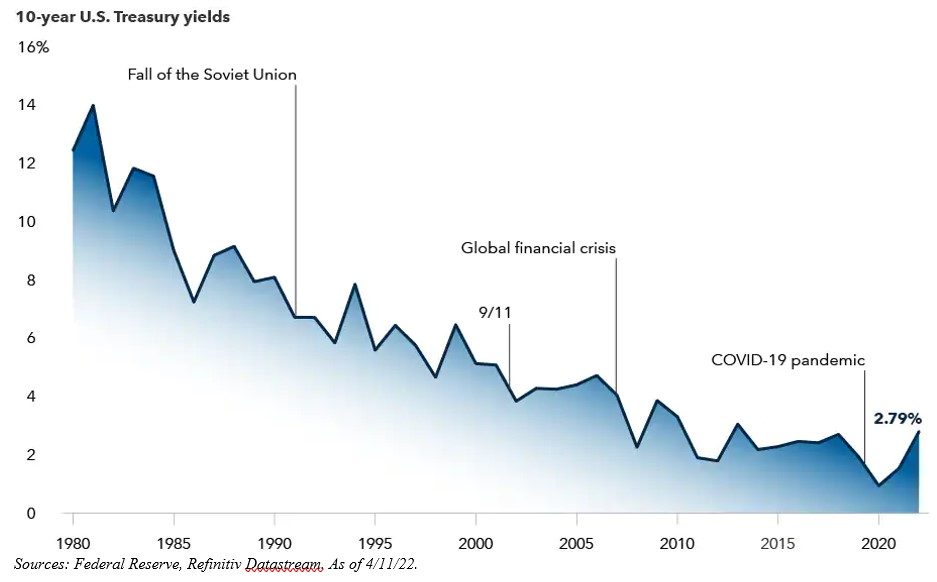

The Federal Reserve has begun to raise short-term interest rates and have signaled that it will continue to this path of rising rates to combat inflation, which is the highest it’s been in forty years. The prospect of more aggressive Federal Reserve has created market disruption and pushed up the 10-year Treasury, a key measure for various loans such as mortgages, to around 3%. But as the chart below shows, these rates are still lower by historical standards.

This could be the end of free money, but we do not think that it is the end of easy money.

The events of today can feel unsettling and while monetary policy will arguably be the main technique the Federal Reserve will use to combat inflation, there will be other policy levers that can be pulled.

- The Federal Reserve could reduce their bond purchases

- Tax rates are maintained or even lowered

- We see a reduction in regulations on the energy sector

- Government reduces their discretionary spending

- Policymakers commit to making sure the public knows another lockdown is not in the cards

Now we probably won’t see all of these come to fruition in the near-term, but there are options to combat the current headwinds. We are also in an election year and with mid-terms only six months away, we do not anticipate any large swings in public policy. In addition, the election results could provide more balance to our government, that too could bode well for future policy and thus the economy. And lastly, while we do not want to comment on the avenues of war, a resolution in Ukraine will more than likely provide a further tailwind to the markets in the future.

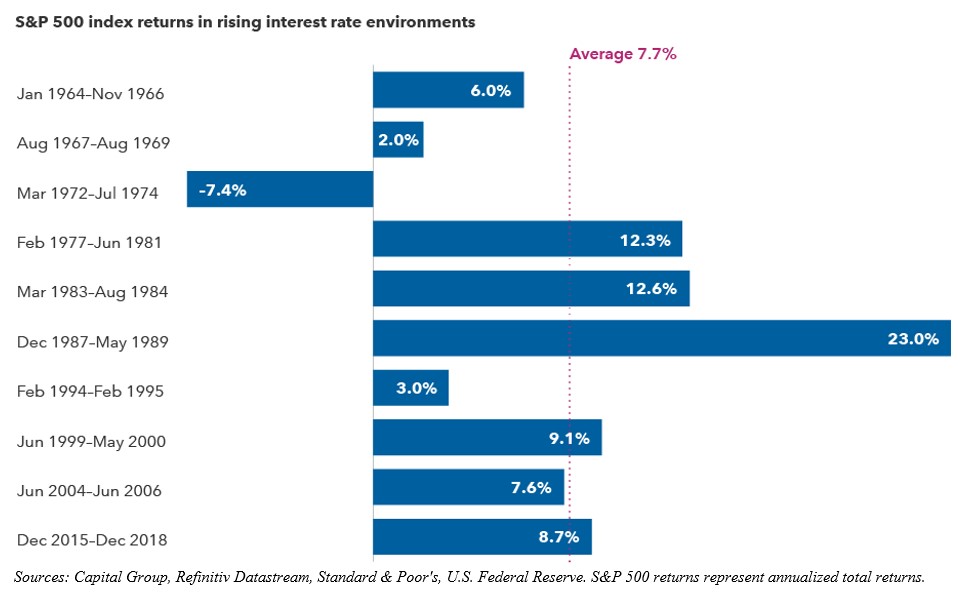

We will end this month’s comments where we started, rising interest rates. The chart below shows how markets have behaved over the past ten rising interest rate environments, in fact, the S&P 500 has averaged a gain of 7.7% through these rising rate cycles.

It always feels different “this time”, that is why we maintain balance in the investment allocation and understand the importance of having a plan for your prosperity. It’s time in, not timing that creates long-term value.

We are always available, so please do not hesitate to give us a call to discuss the markets and your planning. Thank you for the trust you have placed in our firm.

Fee-based planning offered through Focus On Success, LLC, a State Registered Investment Advisor. Third Party Money Management offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc., member FINRA, SIPC. (130 Springside Dr. Suite 300 Akron, Ohio 44333-2431 Ph. 1-800-765-5201). Focus On Success, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

The material contained in the commentary is for informational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. Consult your tax professional for advice. Information provided as an incidental service to our business as (insurance professionals, financial planner, investment advisor, securities broker)

*Past performance does not guarantee future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Indices are unmanaged and do not incur fees, one cannot directly invest in an index.