Economic & Market Outlook

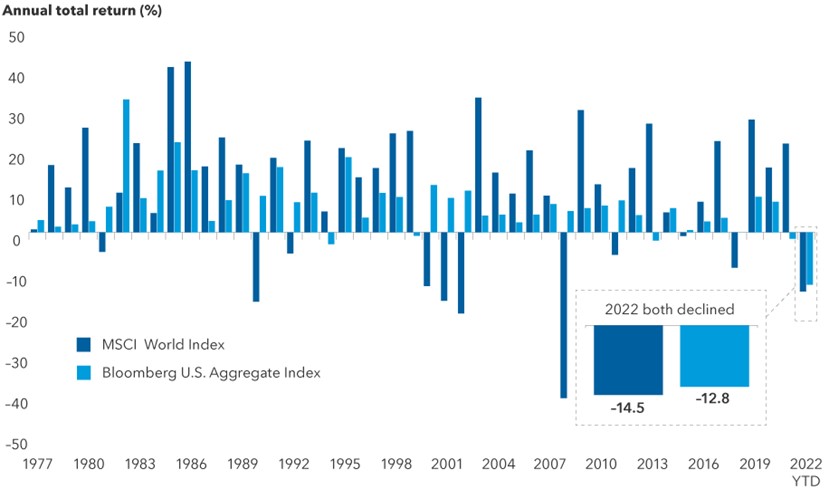

The combination of energy price pressure, a war in Ukraine, mid-term elections, and the leading contributor, the U.S. Federal Reserve and other major central bank initiating a series of aggressive interest rate hikes to fight inflation, lead to both stocks and bonds falling in tandem during 2022. This is a rare outcome and one that we have not seen in the past 45 years.

The lagged effects of these actions will continue to weigh markets into 2023, but good news, inflation has already shown signs of slowing. During their December meeting, the U.S. Federal Reserve moderated its approach and lifted interest rates by a half percentage point to a range of 4.25% to 4.50%. If the Fed sees further evidence of slower inflation or slowing growth, it could allow them to further slow or pause its rate hikes.

The lagged effects of these actions will continue to weigh markets into 2023, but good news, inflation has already shown signs of slowing. During their December meeting, the U.S. Federal Reserve moderated its approach and lifted interest rates by a half percentage point to a range of 4.25% to 4.50%. If the Fed sees further evidence of slower inflation or slowing growth, it could allow them to further slow or pause its rate hikes.

So, what does this mean for investors in 2023? Should we expect a recession or are we already in one? Although we are not able to predict a recession or the exact timing, we do know that every recession in the past has been painful in its own way, but one potential bright spot is that they do not historically last very long. Capital Group analyzed the last eleven U.S. cycles since 1950 and found that recessions have ranged from two to 18 months, with the average lasting about 13 months1.

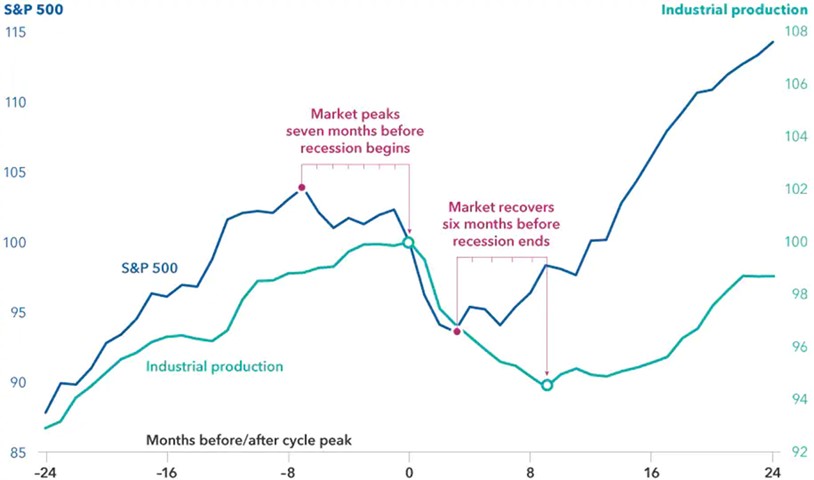

Let us look at the chart below. Stocks generally peak seven months before a recession begins and stocks historically begin to recover before a recession ends, anticipating a better future ahead. If history is a guide, they could rebound about six months before the economy does.

Furthermore, the strongest gains often occur immediately after a bottom and the benefits of capturing a full market recovery can be compelling. On average since 1950, bull markets have lasted 65 months with an average total return of 265%, compared to bear markets that have lasted on average 13 months and experienced a decline of 33%1. Therefore, timing the market can be challenging and waiting on the sidelines for an economic turnaround is not a recommended strategy.

Furthermore, the strongest gains often occur immediately after a bottom and the benefits of capturing a full market recovery can be compelling. On average since 1950, bull markets have lasted 65 months with an average total return of 265%, compared to bear markets that have lasted on average 13 months and experienced a decline of 33%1. Therefore, timing the market can be challenging and waiting on the sidelines for an economic turnaround is not a recommended strategy.

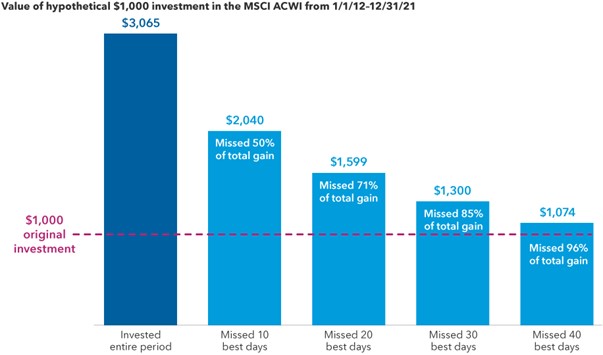

What is important for investors is to stick with their long-term investment plans. Understanding that today’s climate can be unsettling, we need to do our best to avoid playing into the powerful emotions that can lead to spontaneous action. Taking your money out of the market on the way down means that if you do not get back in at exactly the right time, you cannot capture the full benefit of a recovery. As the chart below shows, over the last 10 years, staying invested was beneficial and just missing a few of the best days provided far lesser results.

This time again feels different, it always does during times of turmoil. “Some people say they want to wait for a clearer view of the future. But when the future is again clear, the present bargains will have vanished. In fact, does anyone think that today’s prices will prevail once full confidence has been restored?” – Dean Winter in May of 1932, during one of the deepest points of the Great Depression.

We agree with Dean. Let us take confidence in knowing that we have a plan and let us have courage to know that we have been here before and have prospered. We wish your family and you a prosperous 2023.

Fee-based planning offered through Focus On Success, LLC, a State Registered Investment Advisor. Third Party Money Management offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc., member FINRA, SIPC. (130 Springside Dr. Suite 300 Akron, Ohio 44333-2431 Ph. 1-800-765-5201). Focus On Success, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

The material contained in this document is for informational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. The information provided has been derived from sources believed to be reliable but is not guaranteed the accuracy and does not purport to be a complete analysis of the material discussed. This material is not intended to provide and should not be relied on for tax or legal advice. Any information contained herein is of a general nature. You should seek specific advice from your tax or legal professional before pursuing any idea contemplated. Past performance is not an indication of future results. The Standard & Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. It is not possible to invest directly in an index. Diversification cannot assure a profit or guarantee against a loss.

Past performance does not guarantee future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Indices are unmanaged and do not incur fees, one cannot directly invest in an index.

The information provided has been derived from sources believed to be reliable, but is not guaranteed the accuracy and does not purport to be a complete analysis of the material discussed. All examples are hypothetical and are for illustration purposes only.