The last time U.S. headline inflation was above 9%, IBM was selling their first personal computer using Microsoft software, Ronald Reagan was president and Marty McFly was traveling Back To The Future. In some ways, it feels like we are taking a trip back to the 1980s as the Federal Reserve has made a strong stance in raising interest rates, global economies continue to experience high levels of inflation, there is an unwelcomed proxy war with Russia and the stock market has entered bear market territory. Today’s market environment, however, has been shaped by an entirely different event. The COVID-19 pandemic and the response to the pandemic have created large distortions in the economy and markets — from sky-high inflation to chronic labor shortages to broken supply chains.

We are reminded of the famous Milton Friedman quote: ‘Inflation is always and everywhere a monetary phenomenon.” In other words, inflation is caused by too much money chasing after too few goods, and that is exactly what we are seeing today.

It is normal to be asking: Is it going to get better or worse? How long is this going last? How do the challenges of today impact my financial situation? These are not easy times, we are being tested, but let’s take confidence in knowing that we have worked together to establish a long-term plan for times like these.

While there are certain economic indicators today that show a possibility of a recession, it is difficult to predict the exact timing, severity, and length of such recession. Recessions can be painful but are a natural and necessary means to bring the supply and demand for goods/services back into line before the next period of economic expansion.

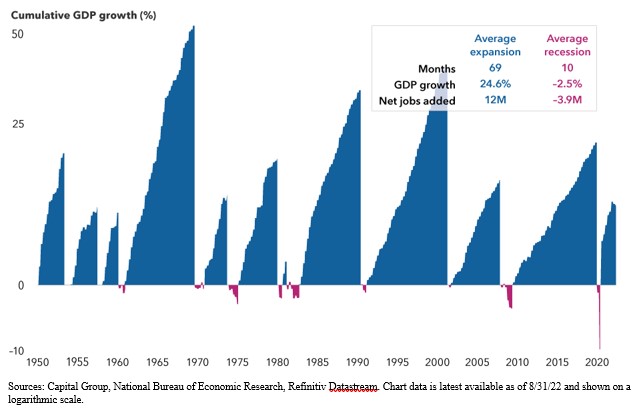

As the chart below shows, over the past 70 years, the U.S. has been in an official recession less than 15% of all months. Moreover, the net economic impact of a recession has been relatively small lasting an average of 10 months. The U.S. economy grew by an average of 24.6% during these periods of economic expansion (as shown in blue), whereas the average recession reduced our economy by 2.5% (shown in red). All previous recessions had an end, and any future recession will too.

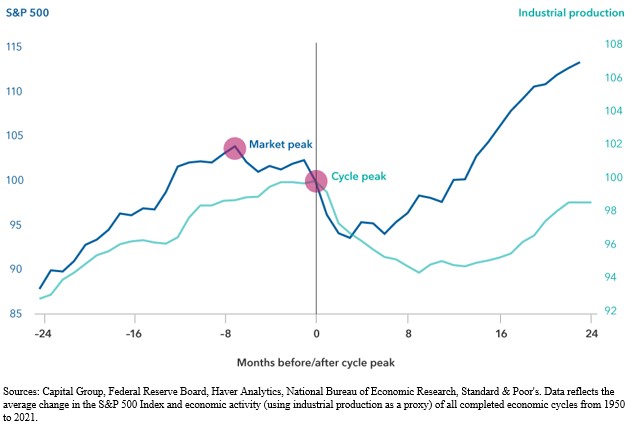

As we try to understand the timing and length of such recession, the next chart lays out how stocks (represented in the dark blue line), have historically peaked months before the start of a recession. The cycle peak is where economic activity (indicated in the turquoise line), begins to decline signaling the start of a recession. Furthermore, since the stock market is forward looking, stocks often begin to trend upward months before economic activity has bottomed.

As the global economies work through these challenges, volatility will exist in the short-term and it could be some time until the markets come back to predictability. And although this time may feel different, long-term history has shown that it is difficult to time the market’s recovery and the best way to weather a downturn could be to stick to your plan. Regardless, these are challenging times, so remember the following if we continue to experience higher levels of market volatility.

- Stay calm and keep a long-term perspective

- Together we have invested time to develop your plan, we review your plan on a regular basis and we can adjust as circumstances warrant

- We diligently selected investment solutions and have chosen strategies consistent with your personal goals and that have shown a strong history of weathering unique market environments

- You have a balanced investment strategy with a broadly diversified portfolio

- The stock portion of your portfolio has a mix of dividend paying companies and growth-oriented companies

- We have high quality bonds to offset equity volatility and anticipate bonds to start acting like bonds again

- If you need income, we have a smart place to get money when you need it

- If you are accumulating assets for retirement, we recommend that you continue to systematically invest, so to purchase more shares at lower prices when the market eventually rebounds

- Focus on the things you can control, this simply could be monitoring your discretionary expenses

- We are here to talk, please call us anytime

As always, we value the trust you have placed in our firm, we will continue to stay in touch and get through this economic period together.

Fee-based planning offered through Focus On Success, LLC, a State Registered Investment Advisor. Third Party Money Management offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc., member FINRA, SIPC. (130 Springside Dr. Suite 300 Akron, Ohio 44333-2431 Ph. 1-800-765-5201). Focus On Success, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

The material contained in this document is for informational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. The information provided has been derived from sources believed to be reliable but is not guaranteed the accuracy and does not purport to be a complete analysis of the material discussed. This material is not intended to provide and should not be relied on for tax or legal advice. Any information contained herein is of a general nature. You should seek specific advice from your tax or legal professional before pursuing any idea contemplated. Past performance is not an indication of future results. The Standard & Poor’s (S&P) 500 Index is an unmanaged index that tracks the performance of 500 widely held, large-capitalization U.S. stocks. Indices are not managed and do not incur fees or expenses. It is not possible to invest directly in an index. Diversification cannot assure a profit or guarantee against a loss.

Past performance does not guarantee future results. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Indices are unmanaged and do not incur fees, one cannot directly invest in an index.