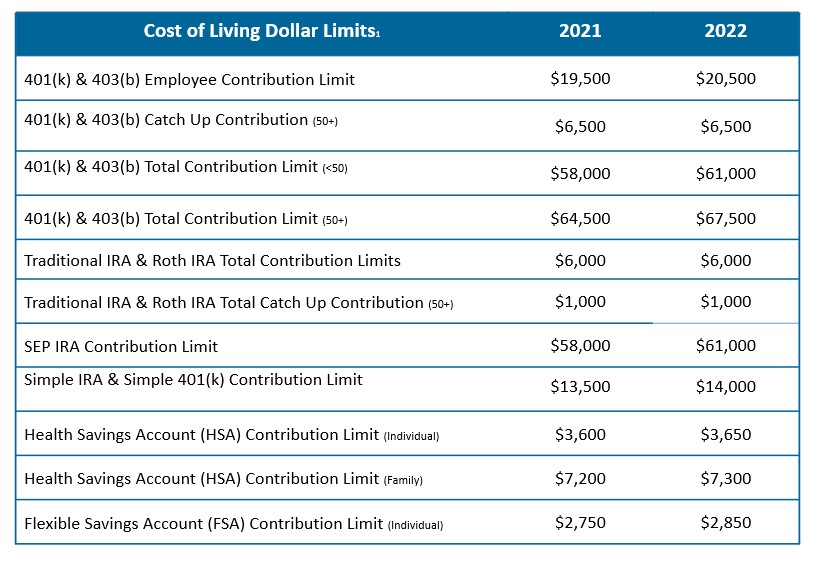

2022 Contribution Limits

On November 4th, 2021, the IRS announced the new 2022 cost of living adjustments for retirement plans.

Preview the changes in the table below:

Fee-based planning offered through Focus On Success, LLC, a State Registered Investment Advisor. Third Party Money Management offered through Valmark Advisers, Inc., an SEC Registered Investment Advisor. Securities offered through Valmark Securities, Inc., member FINRA, SIPC. (130 Springside Dr. Suite 300 Akron, Ohio 44333-2431 Ph. 1-800-765-5201). Focus On Success, LLC is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc.

The material contained in the commentary is for informational purpose only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. Consult your tax professional for advice. Information provided as an incidental service to our business as (insurance professionals, financial planner, investment advisor, securities broker)

1.Dahle, James M. “New 2022 IRS Retirement Plan Contribution Limits [Including 401K & Ira]: White Coat Investor.” The White Coat Investor – Investing & Personal Finance for Doctors, 6 Dec. 2021, https://www.whitecoatinvestor.com/2022-retirement-plan-contribtution-limits/.